Money regularly stood at the center of popular politics in British America. A dearth of currency in England’s colonies led provincial governments to experiment with paper money beginning in the 1690s, and by the middle of the eighteenth century numerous local currencies circulated throughout the Americas. Monetary policy was a regular source of public debate, as colonial newspapers and pamphlets featured arguments over credit relations, the nature of value, and the social function of money. These arguments demonstrated that money was not something natural and immutable, but rather was subject to social and political pressures.

The social and political dimensions of money have become strikingly apparent to us again today. Though the creation of the Federal Reserve in 1913 quieted public discussions of money, the Great Recession of 2007-2009, and the U.S. government’s response to it, returned monetary policy to the public sphere. Occupy Wall Street activists argued that “quantitative easing”—lowered interest rates and the purchasing of mortgage-backed securities, treasury notes, and bank debt—mainly benefited the wealthy and exacerbated inequality. More recently, the rise of cryptocurrencies like Bitcoin and the popularization of Modern Monetary Theory (MMT) has further encouraged questions over the meaning and function of money.1 These questions provide links to our early American predecessors.

Even before large-scale colonization brought Europeans to the Americas, sixteenth-century England was a society increasingly characterized by markets and commerce, and access to credit was essential for economic survival. An inability to repay loans portended default and debtor’s prison. The specter of indebtedness followed English settlers to North America, where there was little money in circulation. Yet beginning in the 1650s, colonial laws regarding default departed substantially from metropolitan norms. Around the same time that colonies began institutionalizing chattel slavery, a number of legislatures legalized the seizure of defaulters’ properties; some even permitted the repayment of debts through servitude. By the 1680s, many mid-Atlantic colonists believed that powerful merchants kept money scarce in order to dispossess debtors of their lands and liberties.2

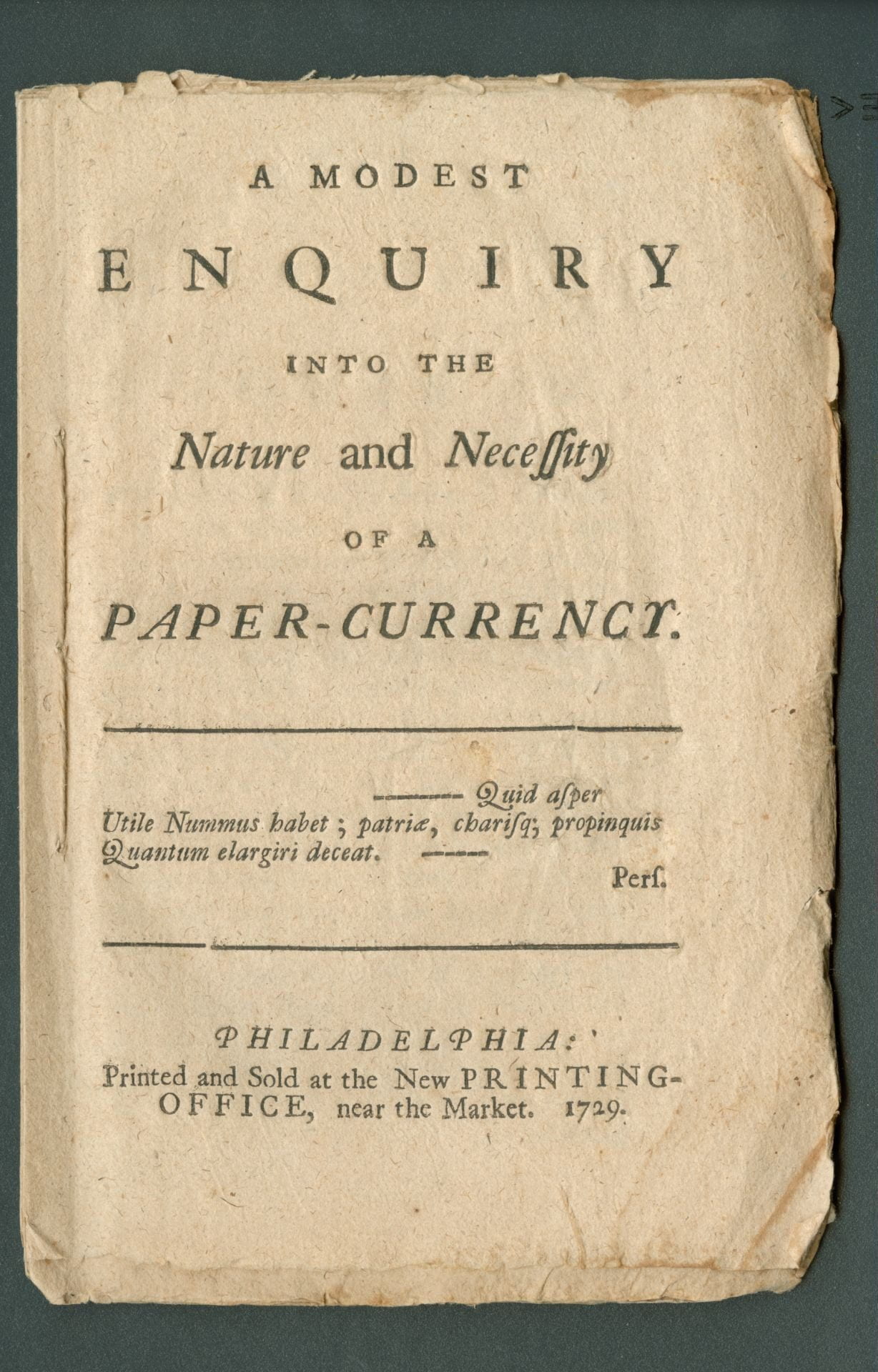

It was in these years that colonists sought to rebalance money’s power by petitioning colonial governments for a circulating medium of exchange. Massachusetts began issuing public bills of credit in 1690. Soon South Carolina, Rhode Island, and New York issued their own paper currencies, as well. Intended initially as a temporary measure to fund wars with the French, early bills of credit allowed many debtors to repay loans while a more abundant medium of exchange stimulated economic development. Paper money remained controversial, however. The Crown was opposed to the practice, and many creditors feared that “imaginary” paper currencies produced inflation that, in addition to raising prices, lessened their wealth.

Though relations between creditors and debtors shaped social conflict from the colonies’ founding, the growth of the colonial press in the early eighteenth century made it possible to represent money in pamphlets, newspapers, and broadsides, accentuating the social power of money. During a pamphlet war over paper money in Philadelphia in the 1720s, anonymous writers lambasted “tyrannical” merchant-creditors who demanded repayment in nonexistent money, while others satirized grandees who feared the democratizing political effects of more paper money.3 The narrative of monetary monopolization became so widespread that opponents of paper bills claimed that stories of local currency’s engrossment had been told as “often to weak People” as “the Tales of the King and Queen of Fairies to Children.”4 In the 1740s and 1750s, broadsides and newspaper editorials attacked urban merchant plans to devalue the British copper halfpence in Philadelphia and New York City. When the devaluations went into effect, townspeople rioted in both cities. As late as the 1760s, the “popular Cry” in New York was for more money and the releasing of debtors from jail.5

Money, and contests over its uses, continued to shape popular politics in the early years of the U.S. republic, and remained an issue of major importance through the nineteenth century. The Massachusetts debtor rising known as Shays’ Rebellion was a primary reason for the Constitutional Convention of 1787, and James Madison noted in Federalist No. 10 that the current “rage for paper money” and “for an abolition of debts” justified his preference for a large republic over a democracy.6 The bank wars of the 1830s were fueled by competing ideas over a national bank, while the agrarian movement that led to the People’s Party, or Populists, in the 1880s was largely driven by farmers’ indebtedness and their desire for a larger and more evenly distributed money supply.

The reintroduction of monetary policy into public discourse in the twenty-first century makes awareness of money’s long history invaluable today. Contemporary debates over the relationship between money, power, and the common good were issues that people in early America also confronted. Knowledge of their arguments and debates can help us rethink the social role of money as we enter a new economic era.

Daniel Johnson (he/him/his) is assistant professor in the Department of American Culture and Literature at Bilkent University. His first book, Making the Early Modern Metropolis: Culture and Power in Pre-Revolutionary Philadelphia, is forthcoming from the University of Virginia Press in 2022. He can be reached at daniel.johnson@bilkent.edu.tr.

Read Daniel Johnson’s article, “‘Nothing will satisfy you but money’: Debt, Freedom, and the Mid-Atlantic Culture of Money, 1670-1764,” in the Winter 2021 issue of Early American Studies.

- For a prominent Occupy voice, see David Graeber, “Against Economics,” New York Review of Books, December 5, 2019. The leading MMT economist Stephanie Kelton’s The Deficit Myth: Modern Monetary Theory and the Birth of the People’s Economy (New York: Public Affairs, 2020) made the New York Times’ bestseller list for hardcover nonfiction in 2020. ↩

- See, for example, Jasper Dankaerts, Journal of Jasper Dankaerts, 1679-1680, eds. Bartlett Burleigh James and J. Franklin Jameson (New York: Charles Scribner’s Sons, 1913), 245-46. ↩

- A Dialogue Between Robert Rich and Roger Plowman (Philadelphia, 1725); The Triumvirate of Pennsylvania (Philadelphia, 1725). ↩

- “Philadelphus,” A View of the Calumnies Lately Spread (Philadelphia, 1729). ↩

- “A Linen Draper,” The Commercial Conduct of the Province of New-York Considered (New York, 1767), 5, 13. ↩

- James Madison, Federalist No. 10, in The Federalist Papers (New York: Signet Classics, 1961), 84. ↩